san francisco payroll tax rate 2021

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Get Started With ADP.

2022 Federal State Payroll Tax Rates For Employers

Payroll Expense Tax.

. List of Employee Employer Payroll Taxes by US City State. San francisco payroll expense tax 2021 rates 5 Best Payroll Companies - Our Best Choice for Jan 2022 best payroll servicesbiz Payroll _CompanyOnline. PAYROLL Computing Pay for Work Done on A Regular Day basic daily rate Daily Rate Monthly Rate X 12 Total working days in a year.

Depending on the business. 2021 Alabama Payroll Taxes - 2021 Alabama Payroll Tax Calculator Birmingham Mobile Montgomery 2021 Arizona Payroll Taxes -. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. SJWC miscalculates the Ad 4 Valorem tax rate of.

Total working days in a year is 313. Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. Discover ADP For Payroll Benefits Time Talent HR More.

For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Discover ADP For Payroll Benefits Time Talent HR More.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L. Effective in 2021 Proposition F 1 1 repeals the 038 percent.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. This 6 federal tax on the first 7000 of each employees earnings is to cover. Depending on the zipcode the sales.

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. Ad Process Payroll Faster Easier With ADP Payroll. This is the total of state county and city sales tax rates.

Ad Process Payroll Faster Easier With ADP Payroll. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

Beginning in 2021 Proposition F named the Business Tax Overhaul raises. Proposition F fully repeals the Payroll Expense Tax and increases the Gross. Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan.

2 The Commission should approve an Ad Valorem tax rate of 12 for TY 2022 3 because the tax rate is based on more recent SJWC data. The minimum combined 2021 sales tax rate for south san francisco california is. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

The tax rate is based on withholdings chosen on the employees W-4 form. Get Started With ADP. Tax rate for nonresidents who work in San Francisco.

2020 San Francisco Payroll Expense. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. 14 San Francisco Business and Tax Regulations Code Article 12 -1 A 953.

The Administrative Office Tax AOT is a 14 tax on the San Francisco payroll expense of a person or combined.

Kdv Tax In Turkey Tax Value Added Tax Engagement Rings

Forbearance Delinquencies And Foreclosure By Calculatedrisk By Bill Mcbride Calculatedrisk Newsletter In 2021 Foreclosures Avoid Foreclosure Loan Modification

It Is Absolutely Important For One To Take The Right Steps Towards Registering A Company In Singapore Business Loans Starting A Business Business Bank Account

Price Infographic For Software Testing Companies Outsourcing Qa Software Testing Software Bug Infographic

Covid 19 Response Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Renters Lease Agreement Real Estate Forms Room Rental Agreement Rental Agreement Templates Lease Agreement

We Customize Wells Fargo Bank Statement To Your Specifications Including Direct Deposits Credits Wells Fargo Account Statement Template Wells Fargo Checking

Meeting Notice Samples Meeting Effective Meetings Beginning Writing

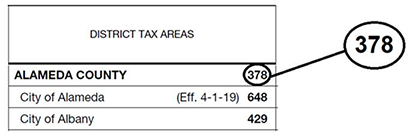

Information For Local Jurisdictions And Districts

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

San Francisco Gross Receipts Tax

Annual Business Tax Return Treasurer Tax Collector

Pin By Natalia Moline On Disaster Prep For Fire Flood Etc In 2022 Monte Rio Central California Lake Berryessa

Top Web Design Agencies In The United Kingdom Uk March 2022 Web Design Agency Web Design Firm Web Design

Technical Service Report Template 1 Templates Example Templates Example Report Template Pamphlet Template Technical